r&d tax credit calculation uk

Our RD tax credit calculator gives you an instant estimate of your potential RD tax credit claim just fill in the fields below. File VAT returns online using HMRC compatible software such as Xero.

How Do You Claim R D Tax Credits

Manufacturing Architecture Engineering Software Tech More.

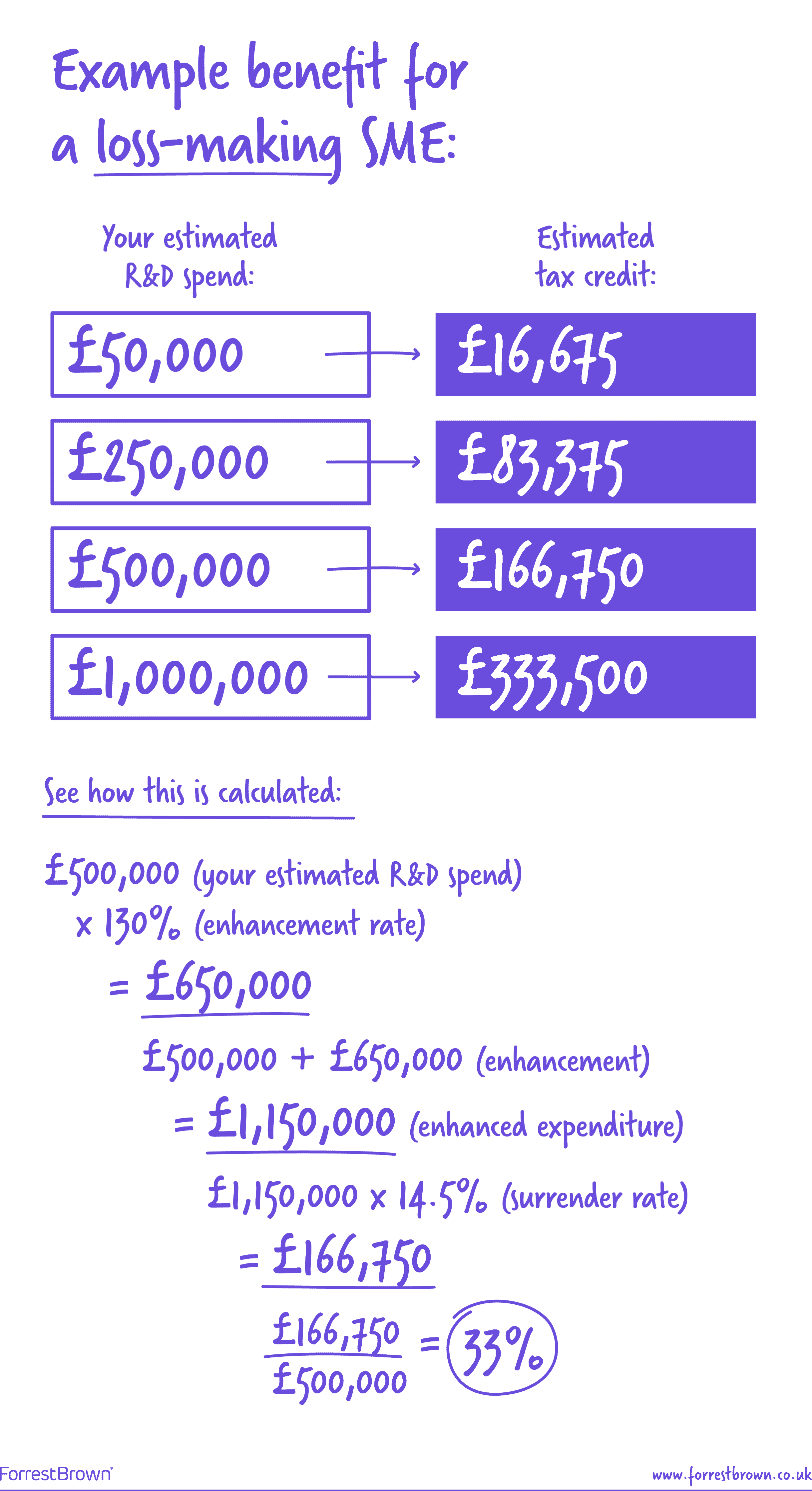

. Learn More At AARP. Ad Aprio performs hundreds of RD Tax Credit studies each year. Put simply the scheme works by returning companies up to 33 of their research and development costs through cash credits and corporation tax.

Premium Federal Tax Software. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. The estimated total Research and Development RD tax relief support claimed for the tax year 20202021 was 66 billion This corresponds to 381 billion in total RD expenditure.

Loss after deduction of profit. Ad Need Software for Making Tax Digital. Maximise your R.

Ad Need Software for Making Tax Digital. The rate at which businesses calculate their RD tax credit depends on whether they are making a profit or a loss. First however the fix-based percentage must be obtained by dividing the QREs for tax years during a base period by the gross receipts from the same.

Guidance on this can be found on our Which RD scheme is right for my company. How to Calculate RD Tax Credit for SMEs. Only 1 in 4 RD Tax Credit Claims are from the Manufacturing Industry alone.

Get Special Innovation Funds Tax Credits To Help Your Business Thrive. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. RD Tax Credits Calculator.

RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. Call 01332 819 740. E-File Today Get Your Refund Fast.

The UK RD tax credit scheme offers UK companies a great opportunity to claim tax relief based on RD costs. Im new to Claming. Our free RD Tax Credit Calculator instantly crunches your numbers and shows how much in RD Tax Credits your business could claim from HMRC.

Select either an SME or Large company. FInsights FInsights gives you industry leading white papers. Roughly how much does your company spend on RD per year.

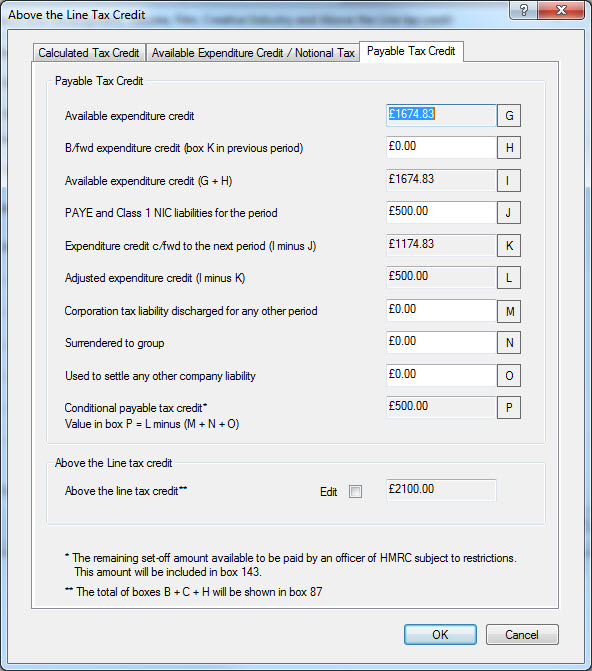

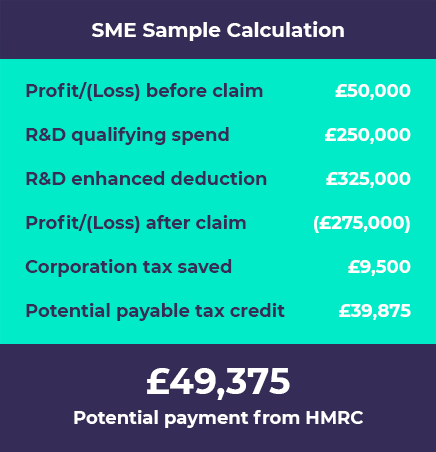

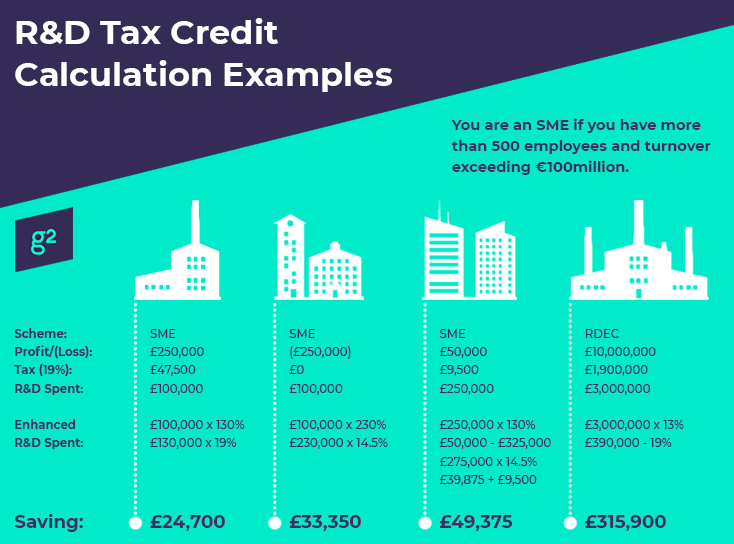

Officerndtaxcouk 181 Chorley New Rd. Calculate how much your research and. 100000 x 230 230000 uplifted qualifying expenditureRD tax losses 230000 x 145 33350 saving or refund.

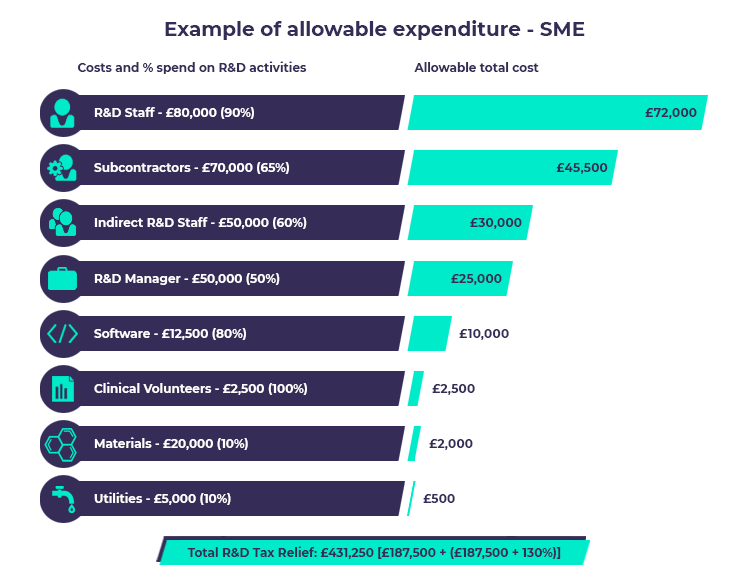

For a profit-making business an RD tax credit. RD Tax Credit Calculation Examples - The calculation of your RD tax relief benefit depends if your company is a Profitable SME Loss making SME or Large Regime RDEC. Just follow the simple steps below.

Most companies in the UK that claim RD tax relief fit into the SME category. 300000 130000 430000 Maximum Losses to surrender. File VAT returns online using HMRC compatible software such as Xero.

Use HMRC-approved software such as Xero. Tax benefits can vary between 8 - 33. RD Tax Credits Whether youre new to RD.

Use HMRC-approved software such as Xero. Ad Contact Us To Find Out How Your Business Can Take Advantage Of Tax Credit Incentives. It was increased to.

On this page you can calculate the value of your Research Development tax credits claim. Corporation Tax prior to RD Tax Credits Claim. If you spend money creating or improving products or services youre probably eligible for an innovation tax refund.

Our highly-specialised friendly team will maximise your RD Claim. R. Ad Did you know.

RD Tax Credits Explained. 100000 X 130 130000. 100000 x 230 230000.

The estimated total number of RD tax credit claims for the tax year. 12 from 1 January 2018 to 31 March 2020. RD Tax Relief also called RD Tax Credits is a UK government subsidy that encourages businesses to invest in innovation.

All Extras are Included. If you dont have all of your numbers to hand call our specialist consultants on 01332 819 740 or email. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

Say our example SME made a loss of 300000 for the year with the same 100000 RD QE and chose to surrender losses and claim relief. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss.

R D Tax Credits 360 Research And Development

R D Tax Credit Rates For Sme Scheme Forrestbrown

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Calculation Examples Mpa

What Is The R D Tax Credit And Could Your Company Qualify

R D Tax Credits 20th September Ppt Download

R D Tax Credits 360 Research And Development

R D Tax Credits Calculator Free To Use No Sign Up Counting King

R D Tax Subsidies In Oecd Countries Tax Foundation

R D Tax Credit Calculator Are You Getting The Full Benefit Of The R D Tax Credit

R D Tax Credits Calculation Examples G2 Innovation

Theatre Tax Relief Example Calculation Examples

R D Tax Credits Explained Are You Eligible What Projects Qualify

The Ultimate R D Tax Credits Guide Explained 2021

R D Tax Credits Calculation Example For Smes Veritas Noble

R D Tax Credits The Essential Guide 2020